oregon tax payment extension

Your browser appears to have cookies disabled. File your Oregon return use the tax payment worksheet on the next page to calculate your extension payment and fol-low the payment instructions under Payment options To avoid.

How To File An Extension For Taxes Form 4868 H R Block

To request an extension for time to file you must.

. Your Oregon corporation tax must be fully paid by the original due date April 15 or else penalties will apply. You dont need to request an Oregon extension unless you owe a payment of Oregon tax. Ad Use our tax forgiveness calculator to estimate potential relief available.

2022 third quarter individual estimated tax payments. Its important to note that a tax extension only gives you more time to file not to pay. Additional extension information is available on the Revenue website.

Oregon recognizes a taxpayers federal extension. An extension to file your return is not an extension of time to pay your taxes. To pay the 150 minimum tax check the extension box on voucher Form OR-65-V and send the voucher and payment by.

If you owe taxes you must pay at least 90 of your total tax liability by April 15 2022 to avoid. KTVZ The Oregon Department of Revenue announced Tuesday an expansion of the types of tax returns for which filing and payment deadlines have been. The Oregon tax payment deadline for payments due with the tax year 2019 tax return is automatically extended to July 15 2020.

Federal automatic extension federal Form 4868. The service provider will tell you the amount of the fee during the transaction. An extension to file is not an extension to pay.

To Oct 15 for calendar years The due date is the 15th day of. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. The time for making estimated tax payments.

An extension of time to file your return is not an extension of time to pay your tax. Oregon uses Form 40-V the payment voucher to file an extension request with payment - just check the extension payment checkbox to apply for an automatic six-month extension of time. Submit your application by going to Revenue.

Your Oregon income tax must be fully paid by the original due date April 15 or else penalties will apply. If you owe Oregon personal. The March 24 Directors Order 2020-01 on extending personal and corporate income tax filing and payment dates.

You can pay tax penalties and interest using Revenue Online. Mail a check or money order. Include payment of the estimated.

Once your transaction is processed youll receive a confirmation number. Refunds and zero balance CAT Tax. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and.

To request an Oregon extension file Form 40-EXT by the original due date of your return. A tax extension gives you more time to file but not more time to pay. KTVZ -- The Oregon Department of Revenue said Wednesday it is joining the IRS and automatically extending the income tax filing due date for individuals for the.

Cookies are required to use this site. Electronic payment from your checking or savings account through the Oregon Tax Payment System. Only request an Oregon extension if you dont have a.

Keep this number as proof of. The 4th month following the tax year end. 2022 second quarter individual estimated tax payments.

The Oregon Department of Revenue announced it is joining the IRS and automatically extending the tax year 2020 filing due date for individuals from April 15 2021 to. The Oregon income tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Estimated payments extension payments.

You must also mail your tax return by the original due date or by the extended due date if a valid extension is attached. The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July. For details of the extensions see the departments news relea ses.

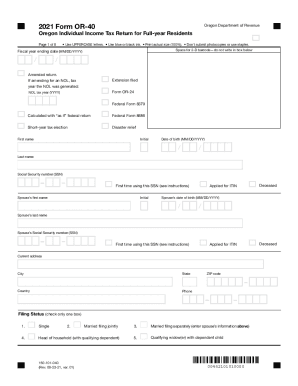

Get And Sign Form Or 40 Oregon Individual Income Tax Return For Full 2021 2022

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

E File Oregon Taxes For A Fast Tax Refund E File Com

Oregon Income Tax Fill Online Printable Fillable Blank Pdffiller

Oregon Tax Return Rejected Anyone Else Getting This R Turbotax

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

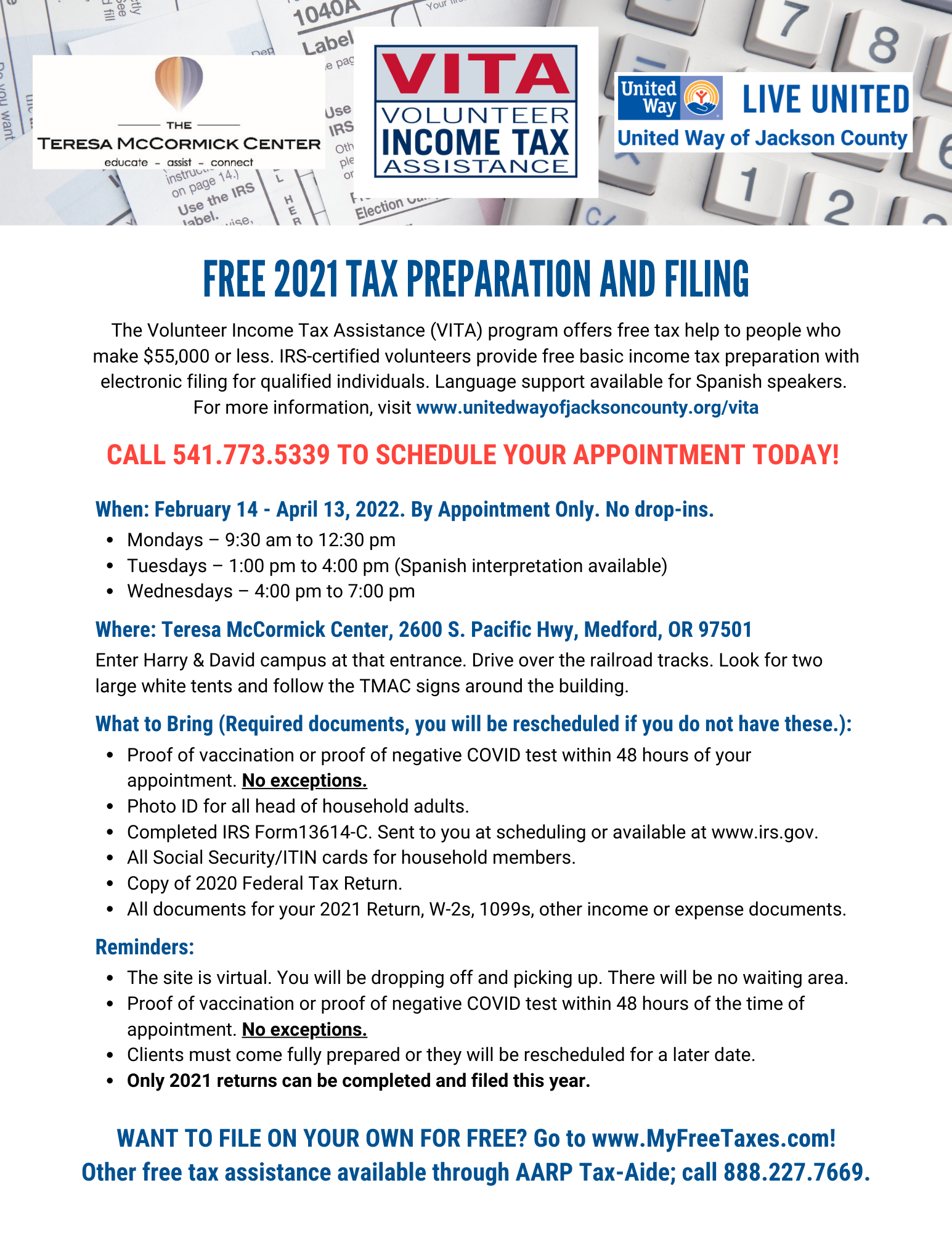

Vita United Way Of Jackson County Medford Oregon

Fill Free Fillable Forms For The State Of Oregon

2020 Tax Deadline Extension What You Need To Know Taxact

Tax Extension 2021 If You Ve Flaked On Tax Prep Here S What To Know About Getting An Extension Glamour

Blog Oregon Restaurant Lodging Association

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

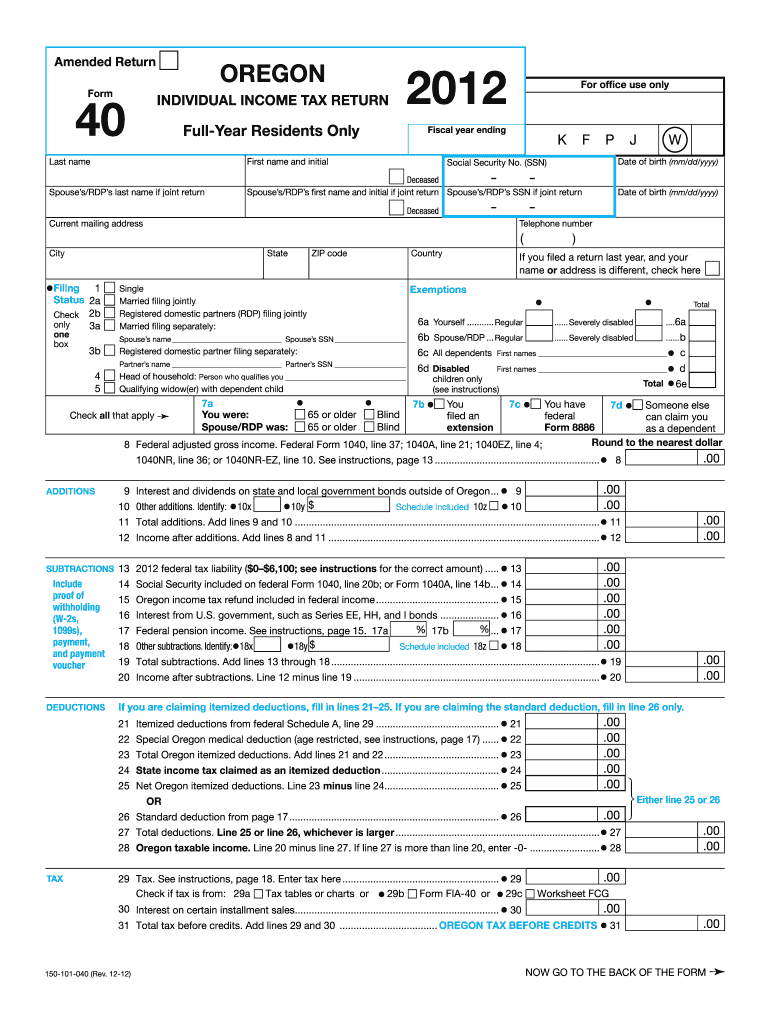

Form 40 Fillable Full Year Resident Individual Income Tax Return Form

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors